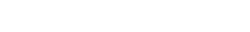

In the latest Budget, Rishi Sunak announced that the lifetime allowance (LTA), which governs how much can be saved in a pension before tax charges apply, would remain at its current level of £1.073m until 2025/26.

This is a reversal of policy introduced three years ago where the LTA was due to an increase in line with inflation.

The change has come due to the increasing pressure on the Treasury to raise revenue due to the unprecedented levels of debt the UK has accumulated because of the global pandemic.

The potential amounts that could be raised as a result of this change have been set out and certified by the Office for Budget Responsibility and by the end of the tax year 2025/26 this could be approaching £1bn.

The LTA is a very important pension consideration.

It effectively sets the maximum tax efficient value of all your retirement benefits, assuming you have not already applied for any of the protections that are available.

If your accumulated pension benefits exceed the LTA there is a tax charge which is 25 per cent if the excess is drawn as taxable income and 55 per cent if it

is received as a lump sum.

When the LTA was first introduced in 2006, it was set at £1.5m, a level which equated to an annual pension income of £75,000.

The initial legislation set out increases for the LTA to £1.8m in 2010/11. That proved to be the LTA’s highwater mark.

It was frozen in the following year and then the first of three cuts were introduced. By 2016/17 the LTA was down to £1m.

The freezing of the Lifetime Allowance has three consequences:

- The total pension protected from the Lifetime Allowance tax charge has fallen.

Currently for someone in a defined benefit (final salary) scheme, due to the way the calculation works, it is £53,655. For defined contribution pension arrangements, such as personal pensions, the erosion is greater.

Low annuity rates mean that £1,073,100 will buy an inflation-proofed income of just over £26,970 a year (before tax) for a 65-year-old on a single life basis with a guaranteed period of five years increasing in line with inflation.

- More people are being caught by the special tax charge.

HMRC’s latest figures showed there were over 4,500 LTA charge payers in 2017/18 against 1,240 five years earlier.

This is now likely to increase further of course over the coming years.

- The legislative protections, some of which date back to 2006, are now all the more valuable as they provide protection in some cases much greater than the current LTA.

At Armstrong Watson, our quest is to help our clients achieve prosperity, a secure future and peace of mind. If you think you might need to consider how you may be impacted by the Lifetime Allowance, either based on current benefits or when you reach retirement, you could benefit from personalised financial advice.

We can provide a full review of your pension arrangements, with our compliments in the first instance, to help you to understand, based on your individual circumstances and arrangements, your position with regards to your current pension arrangements and whether this is an area you need to consider.

If you would like to discuss your pension arrangements, please get in touch with Paul Moody on 01768 222030 or email paul.moody@armstrongwatson.co.uk